First off, we owe a debt of gratitude to the grocers, their manufacturers and the armies of men and women who work in the stores, in the warehouses and along the entire supply chain.

We’ve had a front row seat at watching how the Covid-19 crisis has impacted the availability of products at retail. Pensa watches retail shelves. Its eyes in the air dissect what is happening on the shelf. Looking automatically for stockouts and helping the grocers and manufacturers ensure it doesn’t happen.

The Initial Shock:

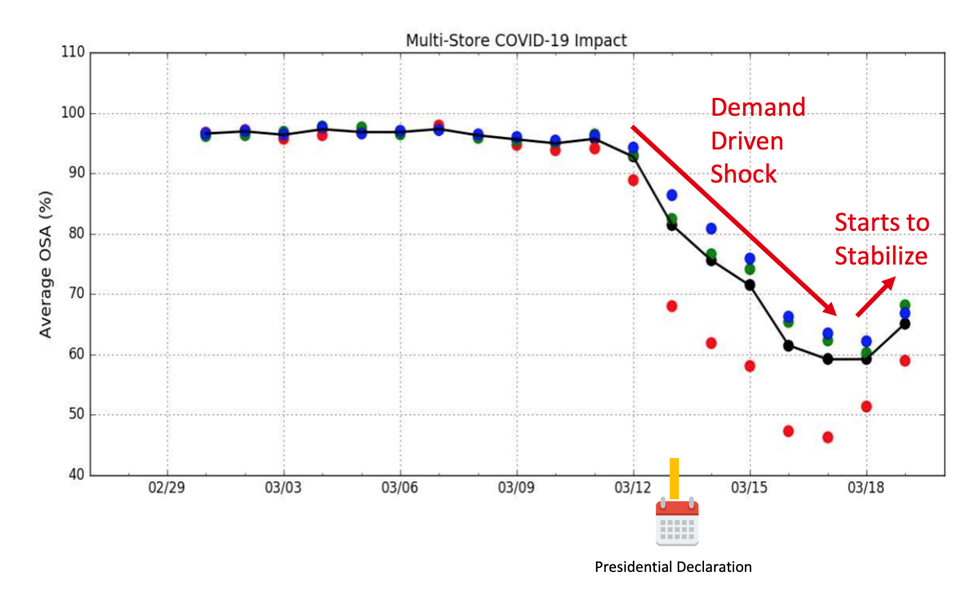

Take a look at the visual timeline above. We show the cereal aisle to illustrate the point. You can see what it looked like just prior to the presidential announcement of a national emergency on Friday March 13th. Just prior, all normal. Just after, there was a run on cereal. The impact was swift and immediate, with on shelf availability levels dropping steadily and drastically each day. Wednesday, March 18th shows the aftermath and the low point. Then, the supply chain starts to recover, slowly starting to move toward more stability, albeit at still a historically low level for OSA.

You can see below the chart of cereal in-stock just prior and just after the presidential announcement (shown as the orange line). The black line is cereal overall and the red dots are the top sellers. Things were already starting to happen just prior to the announcement then went sharply downhill dropping from a more typical OSA in the mid-90s to a low of 60%. Top Selling SKUs (shown in red) were especially hard hit, with OSAs dropping to 47% as consumers had a “return to staples” buying pattern. But then, OSA started to stabilize as the supply chain went into overdrive.

The Response:

Supply chains for manufacturing and delivering products to the grocery store are quite robust. There are long term models of how fast each product in each category is consumed. And therefore, how much to make and how much to deliver when to each retail location. Those assumptions fell by the wayside when the national emergency was declared.

Moving into overdrive, retailers and manufacturers, and truckers and clerks and merchandisers sprang into action. Correcting for the sudden surge in demand by pumping the products through the supply chain faster. And beginning to catch up as manufacturing and supply chains adjust to heightened near-term demand levels.

For our partners, having real-time visibility into what is happening on the shelves has given them crucial added context for making these agile and continuing decisions on what to ship where, what to forecast and even what to manufacture.

Moving Forward:

This is a work in progress. On-shelf availability is still only at 70% – that is, a 30% stockout level, which is still unacceptable for steady state. Looking in more detail, there is a differentially large hit on top-moving products in each category. Ultimately, it is likely that the entire assortment in each aisle and the entire store will need to be re-balanced.

Our prediction is that retailers and brand manufacturers will take advantage of this to move toward more real-time planning and prediction for shelf management at retail. Rather than a once-or-twice-a-year re-planning exercise for each category, we anticipate more real-time instructions each week for how to best use available shelf space for product mix and for optimizing store operations and merchandizing.

We intend to offer subsequent views into what’s happening on the shelves through this crisis. More to come. Life-critical, for all the reasons we know.

Stay safe.