As Pensa is on the frontline of solving the so-called omni-channel shopping problem, we were recently asked to shed light on the problem as well as highlight best practices to address it and the role of in-store automation. The above video is from that talk at the annual Category Management Association conference.

Grocery stores have become ground zero for omni-channel shopping – the practice of buying online to pick up at the curb or to have delivered to your home – now rapidly expanding in popularity. Yet, as all consumers are aware, our online grocery orders are frequently not what we expect when eagerly unpacking what we receive. In fact, today, the industry is struggling with up to 30% basket substitution rates due to retailer stockouts and inaccurate methods of knowing what products are actually on the shelf and available for sale.

Pensa has been working with retailers, delivery partners and consumer brands to provide a source of “truth” about what is actually on the shelf to minimize surprise basket substitutions for consumers and distorted views of shopper preferences caused by ordered but later unavailable choices when a delivery partner shops on the consumer’s behalf.

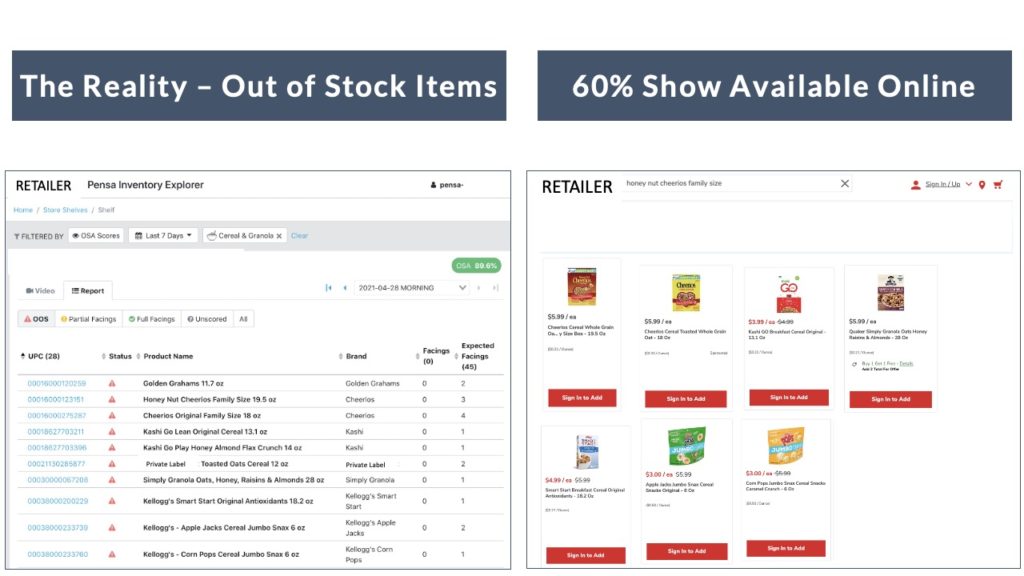

But up to 30% basket substitutions is actually only the tip of the iceberg. Anecdotally, we see up to even 60% or more of products that are out of stock actually showing up as available for sale online.

Pensa’s automated computer vision and artificial intelligence are being used today to monitor the grocery shelf continuously for stockouts, low quantity on hand, and misplacements of products within the store. That means, we are able to see not just the substitutions which actually occur, but the problems waiting to happen, where things are offered for sale and not available.

We’ll talk in subsequent blogs in this series about how consumer brand manufacturers can win or lose by better understanding online on-shelf-availability. That is, how to work with the retailer and delivery partners to ensure items are going to be available for delivery, as promised. And, when in-store stock on hand is predicted to be running low, how to offer a different item for online purchase. This is critical to maintain customer loyalty and grow revenue, and most of all to avoid the ultimate sin … losing customers and their loyalty to a competitor.

As the future of retail is remade, omni-channel shopper insights and omni-channel retailer performance will continue to be the new battleground for the market share war. This is why you need to have access to real-time data to support your omnichannel growth and avoid being left behind.